WELCOMEFROM OURCEO

Welcome to Gridworks’ first development report. It sets out the progress made since we were established and underlines the ambition of our organisation to create impact. On these pages, we share a selection of highlights from the publication – if you’d like to explore the report in more depth, please click to download it in full.

We want our work to contribute to the evolution of viable electricity networks in Africa that will be able to serve a larger proportion of the continent’s population. In doing so, we can increase the uptake of renewable power and provide African businesses with the quantity and quality of power necessary to underpin industrialisation and wider economic growth.

I am incredibly proud of our achievements and of the things we have learnt since our launch in 2019. I am pleased to share those lessons here, as well as our plans for going further in the future.

Best wishes,

Simon Hodson, CEO

OURINTENDEDIMPACT

We were established by British International Investment in 2019 to address the chronic shortage of investment in Africa’s electricity networks. This need is evidenced by significant independent research, including a study by McKinsey which found that $345 billion of investment is needed in transmission and distribution in Africa by 2040, of which $80 billion is needed in transmission.

Our long-term aim is to develop and invest in sustainable electricity network infrastructure that enables increased access to energy, improves the availability of energy for business, and cuts greenhouse gas emissions. These are all important elements of delivering the Sustainable Development Goals (SDGs).

Deep and lasting impact in these areas requires a great deal of groundwork over a long period of time, in collaboration with others. The activities described in this report are essential building blocks in creating sustainable businesses that can better serve their customers and attract the finance needed to meet Africa’s social, economic and climate challenges.

You can find out more about how we measure impact for each of our projects on page 14 of the report

OURINVESTMENTS

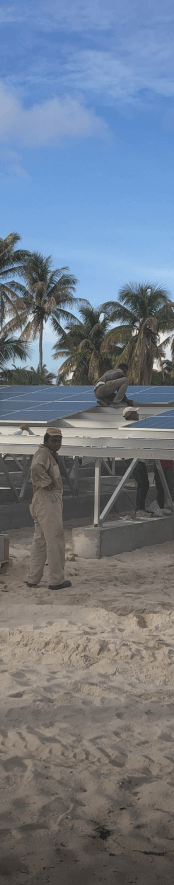

We’re developing several demonstration and pathfinder projects, while working practically to address barriers in the market. In some cases, these projects would not have happened without our involvement, while in others they may have otherwise resulted in higher costs to governments and end users.

“Gridworks are professional people, who have been in the sector for quite some time. I think they have great ideas to make further investments in the (..T+D…) sector, and make it more feasible for the private sector to get involved - which is not an easy task.”

Huub Cornelissen, Director, Energy Department, FMO

OURINVESTMENTS

We’re developing several demonstration and pathfinder projects, while working practically to address barriers in the market. In some cases, these projects would not have happened without our involvement, while in others they may have otherwise resulted in higher costs to governments and end users.

“Gridworks are professional people, who have been in the sector for quite some time. I think they have great ideas to make further investments in the (..T+D…) sector, and make it more feasible for the private sector to get involved - which is not an easy task.”

Huub Cornelissen, Director, Energy Department, FMO

WhatHave welearnt

“The big issue in African transmission and distribution is financing and funding, and Gridworks’ approach currently is the ideal one. They have funding and are identifying the key partners up front, those with the right experience, knowledge and technology.”

Megandran (Megz) Naidoo, Country Head - Transmission Service, Siemens Energy

WhatHave welearnt

“The big issue in African transmission and distribution is financing and funding, and Gridworks’ approach currently is the ideal one. They have funding and are identifying the key partners up front, those with the right experience, knowledge and technology.”

Alice Chapple, Development Impact Advisor

01

it takes time to get things right

We’re trying to introduce new ways of investing in transmission and distribution, so it’s natural that it takes time. From building large-scale minigrids, to developing transmission and distribution projects, we’re often working without existing reference points while introducing new concepts.

02

On and off-grid solutions are increasingly linked

The distinction between off-grid and on-grid, C&I and minigrids is blurring, and there are interdependencies. Grid extensions are a key part of increasing energy access, while the off-grid sector is small, has made few connections and has been largely financially unsustainable to date.

It is important for off-grid firms to explore new models that reach commercial and industrial customers. Doing so will help enable them to connect households in a financially sustainable way – we’re working with Moyi Power and Virunga Power to do exactly this.

03

Increasing short-term access at all costs is unsustainable

While there is an urgent need to increase access to energy for those who do not have it, sustainable access to energy will not be achieved through a singular focus on funding new connections. An energy system in Africa that enables sustainable growth and improved livelihoods is not met by requiring a loss-making utility to increase household connections, when each connection adds further losses.

04

Increasing available sources of finance for transmission is vital (including climate finance)

Put simply: the transmission sector in Africa is in desperate need of investment. This will help improve the reliability of existing networks, enable increased wheeling of power within and between countries, and support the growth of renewables on the grid.

The need is huge – and transmission projects are capital-intensive – so the necessary investment may test the depth of capital available when the sector becomes mature. However, well-structured transmission projects will be a good asset class and will offer suitable risk-adjusted returns to attract interest from commercial investors.

05

A better balance of concessional and private finance is required for energy access

Many types of intervention in the energy system need concessional finance. Energy access in particular has required subsidy in most parts of the world while networks are being extended to new users.

At present, too many projects are considered as either (i) concessional projects or publicly funded projects on the one hand, or (ii) private-sector projects on the other. There isn’t enough concessional capital to do the heavily lifting required on the continent of Africa to meet access and climate targets, and many of these models lack robust operating solutions. On the other hand, few energy-access projects can lead to affordable tariffs if they are fully private-sector funded.

Models that use some concessional funding to catalyse private-sector investment and operating capacity are required. We believe, Moyi Power will demonstrate the value of this approach.

“Our ambition is to prove there are commercial opportunities to invest in T&D that would otherwise be ignored or avoided. The projects highlighted in this report – SPS, Moyi Power, Amari and Virunga Power – are all valuable demonstration and pathfinder projects. We will learn from them and apply the lessons to our future investments.”

Alice Chapple, Development Impact Advisor

04

Increasing available sources of finance for transmission is vital (including climate finance)

Put simply: the transmission sector in Africa is in desperate need of investment. This will help improve the reliability of existing networks, enable increased wheeling of power within and between countries, and support the growth of renewables on the grid.

The need is huge – and transmission projects are capital-intensive – so the necessary investment may test the depth of capital available when the sector becomes mature. However, well-structured transmission projects will be a good asset class and will offer suitable risk-adjusted returns to attract interest from commercial investors.

05

A better balance of concessional and private finance is required for energy access

Many types of intervention in the energy system need concessional finance. Energy access in particular has required subsidy in most parts of the world while networks are being extended to new users.

At present, too many projects are considered as either (i) concessional projects or publicly funded projects on the one hand, or (ii) private-sector projects on the other. There isn’t enough concessional capital to do the heavily lifting required on the continent of Africa to meet access and climate targets, and many of these models lack robust operating solutions. On the other hand, few energy-access projects can lead to affordable tariffs if they are fully private-sector funded.

Models that use some concessional funding to catalyse private-sector investment and operating capacity are required. We believe Moyi Power will demonstrate the value of this approach.

“Our ambition is to prove there are commercial opportunities to invest in T&D that would otherwise be ignored or avoided. The projects highlighted in this report – SPS, Moyi Power, Amari and Virunga Power – are all valuable demonstration and pathfinder projects. We will learn from them and apply the lessons to our future investments.”

Megandran Naidoo, Country Head - Transmission Service, Siemens Energy

Find out more

The full version of our Development Report is available to download by clicking the button below.